Delving into NGPF Activity Bank Checking Answers, this guide immerses readers in a unique and compelling narrative that unravels the intricacies of financial literacy, empowering individuals to navigate the complexities of bank checking with confidence. This comprehensive resource provides a thorough overview of key concepts, practical tips, and essential information, equipping readers with the knowledge and skills necessary to manage their checking accounts responsibly.

Through an engaging exploration of checking account statements, bank fees, and responsible account management practices, this guide illuminates the path towards financial well-being. By shedding light on the often-overlooked aspects of bank checking, NGPF Activity Bank Checking Answers empowers individuals to make informed decisions, avoid costly mistakes, and cultivate a financially secure future.

NGPF Activity: Bank Checking Answers

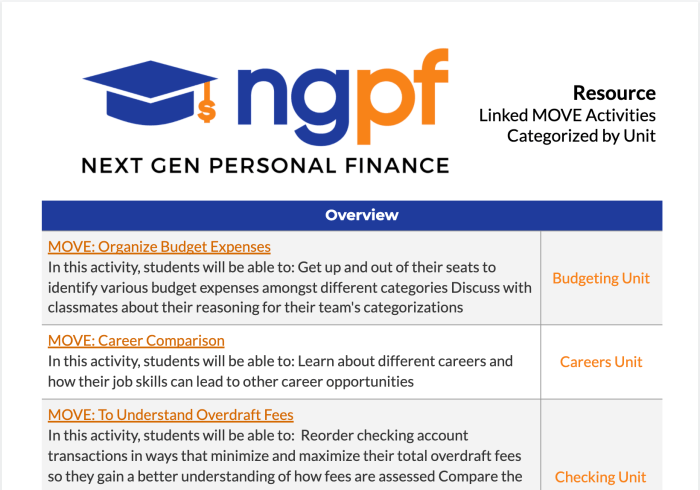

The NGPF activity on bank checking aims to enhance financial literacy among individuals. It provides a comprehensive overview of the fundamental concepts related to bank checking accounts, empowering participants with the knowledge and skills necessary for effective financial management.

The activity delves into various aspects of bank checking accounts, including account types, features, fees, and the importance of responsible account management. Through interactive exercises and real-life scenarios, participants gain practical insights into managing their checking accounts, making informed financial decisions, and avoiding common pitfalls.

Importance of Financial Literacy

Financial literacy is crucial for individuals to navigate the complexities of modern financial systems and make sound financial decisions. It empowers them to manage their finances effectively, plan for the future, and achieve their financial goals. The NGPF activity on bank checking contributes to financial literacy by providing a solid foundation in understanding and utilizing checking accounts, a fundamental aspect of personal finance.

Analyzing Checking Account Statements

Analyzing checking account statements is a crucial part of managing your finances. By understanding the different sections of a statement and identifying important information, you can track your spending, identify errors, and ensure your account is accurate.

Sections of a Checking Account Statement, Ngpf activity bank checking answers

A typical checking account statement includes the following sections:

- Account Summary:Provides an overview of your account, including the current balance, available balance, and any pending transactions.

- Transaction History:Lists all deposits, withdrawals, and other transactions that have occurred during the statement period.

- Account Activity:Shows a summary of your account activity, including the number of deposits, withdrawals, and total amount of interest earned.

- Service Charges:Lists any fees or charges that have been applied to your account, such as overdraft fees or ATM fees.

- Contact Information:Provides the contact information for your bank, in case you need to report any errors or have questions.

Identifying Important Information

When reviewing your checking account statement, it’s important to pay attention to the following information:

- Deposits:Any money that has been added to your account, such as paychecks, direct deposits, or interest payments.

- Withdrawals:Any money that has been taken out of your account, such as purchases, ATM withdrawals, or checks.

- Account Balance:The amount of money that is currently in your account.

- Available Balance:The amount of money that is available to spend, which may be less than the account balance if there are any pending transactions.

Significance of Reconciling a Checking Account Statement

Reconciling your checking account statement means comparing it to your own records to ensure that all transactions have been recorded correctly and that your account balance is accurate. Reconciling your statement regularly can help you:

- Identify any errors or discrepancies in your account.

- Detect unauthorized transactions or fraud.

- Track your spending and identify areas where you can save money.

- Ensure that your account is accurate and up-to-date.

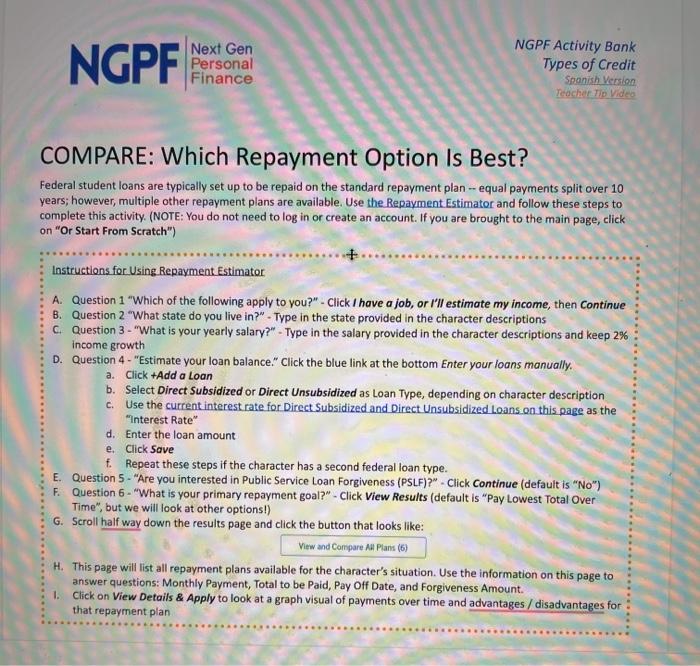

Understanding Bank Fees and Charges: Ngpf Activity Bank Checking Answers

Bank fees and charges can significantly impact your financial well-being. Understanding these fees and implementing strategies to avoid or minimize them is crucial for effective financial management.

Common Bank Fees and Charges

Common bank fees include:

- Overdraft fees: Charged when you spend more money than you have in your account.

- ATM fees: Charged for using ATMs that are not part of your bank’s network.

- Monthly maintenance fees: Charged for maintaining an account with a certain balance.

- Foreign transaction fees: Charged for using your card abroad.

- Wire transfer fees: Charged for sending or receiving money electronically.

Avoiding or Minimizing Bank Fees

To avoid or minimize bank fees, consider the following strategies:

- Keep track of your account balance to avoid overdrafts.

- Use ATMs within your bank’s network to avoid ATM fees.

- Negotiate with your bank to waive or reduce monthly maintenance fees.

- Use alternative payment methods, such as mobile wallets, to avoid foreign transaction fees.

- Compare wire transfer fees from different providers to find the most cost-effective option.

Importance of Reading Bank Fee Schedules

Reading and understanding bank fee schedules is essential for managing your finances effectively. These schedules Artikel the fees and charges associated with different banking services and transactions. By carefully reviewing these schedules, you can make informed decisions about which banking products and services to use and how to avoid unnecessary fees.

Managing a Checking Account Responsibly

Managing a checking account responsibly is crucial for financial stability and well-being. It involves setting a budget, tracking expenses, and avoiding overdrafts to maintain a healthy financial balance.

Irresponsible checking account management can lead to overdraft fees, late payment charges, and damage to credit scores. It can also create a cycle of debt and financial stress.

Benefits of Online and Mobile Banking Tools

Online and mobile banking tools provide convenient and efficient ways to manage checking accounts. These tools allow users to:

- Check account balances and transactions in real-time

- Set up automatic payments and transfers

- Receive account alerts and notifications

- Deposit checks remotely

By leveraging these tools, individuals can stay organized, avoid overdrafts, and make informed financial decisions.

General Inquiries

What is the purpose of the NGPF activity on bank checking?

The NGPF activity on bank checking aims to enhance financial literacy by providing a comprehensive overview of key concepts related to checking accounts, including statement analysis, fee avoidance, and responsible management practices.

How does this activity promote financial literacy?

By engaging participants in hands-on activities and discussions, the NGPF activity fosters a deeper understanding of financial concepts, empowering individuals to make informed decisions and manage their finances effectively.

What are some common bank fees and charges?

Common bank fees include overdraft fees, ATM fees, monthly maintenance fees, and foreign transaction fees. Understanding these fees and implementing strategies to avoid or minimize them is crucial for responsible account management.

What are the benefits of using online and mobile banking tools?

Online and mobile banking tools offer convenience, accessibility, and enhanced security features. They allow users to track their account balances, view transactions, make payments, and manage their finances from anywhere with an internet connection.